About 1,068 oil and gas projects approved between 2022 and 2023 that are currently ongoing across the country are to attract a total of $22.8bn, the Federal Government announced on Wednesday.

It disclosed this during a panel session at the ongoing 7th Nigeria International Energy Summit in Abuja, adding that Nigeria’s technical crude oil production potential was currently 2.26 million barrels per day.

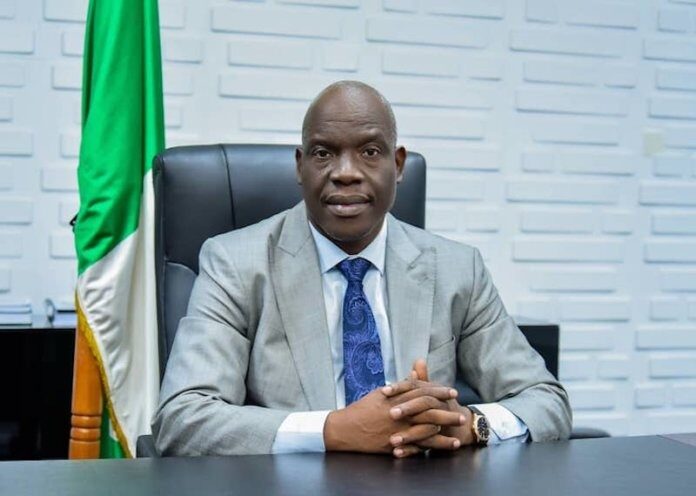

The government revealed this through the Nigeria Upstream Petroleum Regulatory Commission, as the Chief Executive, NUPRC, Gbenga Komolafe, told delegates at the summit that the country was gradually approaching the oil production quota approved by the Organisation of Petroleum Exporting Countries.

Speaking on what he called” success story” in Nigeria’s oil sector, Komolafe said, “A total of 51 Field Development Plans (were) approved in the year 2022 – 2023, expected to attract a total $17.64bn investment inflow as well as deliver cumulative oil recovery and gas recovery estimated at 2.12 billion barrels and 13.13 trillion cubic feet respectively in the next five years.

“A total of circa $2.5bn investment in 175 wells drilling in the year 2022 – 2023. A total of $2.68bn investment in 842 well workovers and other well intervention activities in the year 2022 – 2023 resulting in increased average oil production.

“275 per cent growth in rig count from just eight in 2021 to average of 30 in the past one year. Early first oil achieved in recently streamed fields through accelerated FDPs.

“Some of the fields include: Ikike (Total), Efe field (Newcross), Utapate, (NEPL), Akubo Field (SEEPCo), Oyo (General Hydrocarbon) and several others streamed under Extended Well Tests including Ethiope, Omefejo, Ofa, Olure, Ibom, Apani, Kalaekule, etc.”

He explained that though the actual national crude oil production currently averages 1.33 million barrels per day and 256,000 barrels of condensate per day, the national technical production potential currently stands at 2.26 million bpd, while the current OPEC quota is 1.5 million bpd.

“Closing the gap between the actual oil production and the technical potential presents a window of investment opportunities for investors and a significant opportunity for Nigeria to unlock additional revenue streams, address the current foreign exchange gap and strengthen her economic resilience. So there is opportunity in every disability,” Komolafe stated.

He said the commission had also intensified efforts in collaborating with the International Oil Companies to ensure accelerated maturation and development of some high volume deep offshore assets.

“The commission has created further investment opportunities through the ongoing licensing round for seven deepwater acreages, as well as the proposed 2024 closed bids expected to increase the nation’s reserve and production and boost national revenue.

“At this point, permit me to reiterate that both open and closed bids are permissible by the law as Section 73(1) of the PIA does not preclude either approach, so far as the licensing round is ‘…based on a fair, transparent and competitive bidding process’.”

The NUPRC boss noted that in addition, huge opportunities also exist in Seismic acquisition on multiclient basis, development of deeper hydrocarbon opportunities, drilling and well services in both green and several mature fields, waste management, etc.

“There are also business prospects in decarbonisation and carbon-pricing system currently being stewarded by the commission. Each of these areas provide a unique entry point for willing investors,” Komolafe stated.