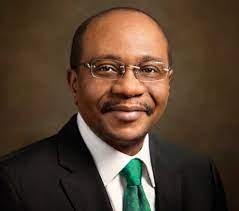

The Governor of the Central Bank of Nigeria (CBN), Mr. Godwin Emefiele say the focus of the Bank remains macroeconomic stability, to build a strong, stable and resilient economy that is self-sustaining and able to weather unanticipated shocks.

Mr. Emefiele disclosed this Monday at the 40th anniversary/convocation lecture of Ekiti State University, Ado-Ekiti, noting that the Act establishing the Bank envisaged the role of development finance, which he stressed the Nigerian context demands.

Speaking on “The Role of Central Banks in Manging Economic Downturns,” he said the intervention of central banks in development financing was not new as it dated back to the 1920s. To support his view, he cited instances of roles played by some central banks in more advanced economies in the financing of government programmes/projects in their early days.

Emefiele, who was represented by the Deputy Governor in charge of Corporate Services at the Bank, Mr. Edward Lametek Adamu, also pointed out that central banks in both advanced and emerging markets embraced quantitative easing to support their economies towards recovery the global financial crisis of 2008/2009 and the associated economic downturn triggered by the COVID-19 pandemic.

He explained that many central banks in advanced, emerging and developing economies, during the recent COVID-19 pandemic, supported their fiscal authorities to aid recovery of their economies following the significant decline in global growth occasioned by the pandemic.

Continuing, he said central banks, particularly in developing countries, intervene in the real economy to enhance the transmission mechanism of monetary policy actions and facilitate the development of financial markets through the creation of easy access to credit for investment and production.

“Thus, it is undeniable that development finance interventions are frequently an integral part of the recovery strategy in most countries, although the degree and method could differ, depending on context as well as the nature and magnitude of shock,” he noted.

According to him, the philosophy behind central banks’ interventions in the real economy is to indirectly influence cost of production for firms and affect prices positively by improving the flow of credit.

While expressing worry that the country’s manufacturing sector contributed less than 15 per

cent of the Gross Domestic Product (GDP).

He decried the situation whereby the country had been importing many commodities, which it has ability to locally produce and export such as rice, maize, milk and dairy products.

To address this challenge in line with the charge of the President, Muhammadu Buhari, that the country produces what it eats and eats what it produces, he said the CBN, working with Deposit Money Banks (DMBs) and participating financial institutions focused on critical areas such as the agricultural and manufacturing sectors and had granted over N3 trillion in intervention loans that had aided economic recovery and employment generation.

Given the limited fiscal space due to the significant drop in government revenue, Emefiele said the CBN had to intervene with development finance tools and some monetary policy innovations to aid recovery without jeopardizing price stability.

Mr. Emefiele further noted that different categories of Nigerians, particularly women and youth, had benefitted from various intervention programmes of the CBN such as the Anchor Borrowers’ Programme (ABP), Targeted Credit Facility, Agri-Business Small and Medium Enterprises Investment Scheme (AGSMEIS), among others.

Recalling his pledge, on assumption of office as Governor in 2014, he said he remained committed to leading a people-focused central bank that will promote macro-economic objectives such as low inflation and stable exchange rates, along with a focus on promoting inclusive growth and reducing unemployment in the country.

With an annual population growth rate of close to 2.8 percent, he emphasised that it was important that all efforts were made to ensure that employment opportunities became available for Nigerians, particularly in sectors that had the potential to absorb the youths.

Highlighting other measures taken by the Central Bank of Nigeria (CBN) to combat the negative impact of the Covid-19 pandemic, he said the Bank, among other policy actions, allowed a one-year extension of the moratorium on principal repayments for CBN intervention facilities; reduced the interest rate on CBN intervention loans from 9 to 5 per cent; and created the N300 billion Targeted Credit Facility (TCF) for affected households and Small and Medium Enterprises (SMEs) through the NIRSAL Microfinance Bank.

He also cited the creation of a N100 billion intervention fund in loans to pharmaceutical companies and healthcare practitioners intending to expand and strengthen the capacity of our healthcare institutions; a research fund, which is designed to support the development of vaccines in Nigeria; and a N1 trillion facility, in loans, to boost local manufacturing and production across critical sectors; the introduction of the Naira for Dollar policy to boost diaspora remittances, as some of the policy measures taken by the Bank to help manage economic downturns in Nigeria.

Emefiele expressed satisfaction that the Bank’s intervention measures in the agriculture and the manufacturing sectors played significant roles in ensuring that the Nigerian economy exited recession in the second quarter of 2017 after five quarters of negative growth, as well as enabled further growth in 12 consecutive quarters following the recession.

“Our external reserves have risen from its low of $33 billion in March 2021, to over $40 billion today. In addition, our policy measures also led to a significant improvement in diaspora inflow from an average of $6 million per week in March 2020 to an average of over $100 million per week by January 2022,” he added.

Furthermore, the CBN Governor disclosed that the Bank, in collaboration with the Bankers’ Committee, was working to boost non-oil exports through the ‘Race to a $200billion’ non-oil exports revenue target (RT 200 FX Programme) over the next three to five years.

“It is our honest view that in the next few years, more jobs will be created, and growth will be much more consolidated above 5 percent with propensity to build an economy that is self-sustaining and capable of withstanding negative external shocks,” he declared.

Highlight of the ceremony, which was witnessed by the Deputy Governor of Ekiti State, Otunba Bisi Egbeyemi, who represented the Governor of Ekiti State, Mr. John Kayode Fayemi, was the presentation of awards to the Governor of the CBN by the Ekiti State University as well as the Students’ Union Government (SUG) of the school.