Nigeria’s 12 oil bid round will be transparent – FG

By Chigozie Amadi

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has expressed the commission’s determination to conduct Nigeria’s 2024 bid round in a transparent manner.

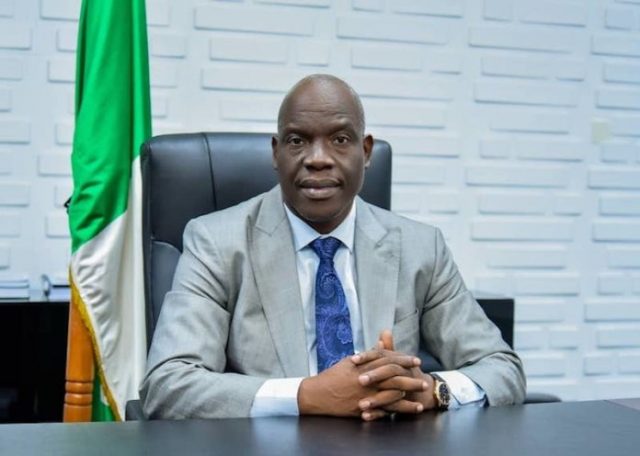

Mr Gbenga Komolafe, the Chief Executive of the commission, gave the assurance on Tuesday during the 2024 Pre-bid conference in Lagos.

The theme of the conference is, “Unveiling Nigerian Energy Development Strategies: 2024 Licensing Round”.

He said that the bid would be in accordance with Section 76 (1) of the Petroleum Industry Act (PIA).

Komolafe said said that Nigeria is an attractive jurisdiction for investment, adding that the country has a stable regime, driven by laws.

According to him, Nigeria is a stable political environment that encourages businesses in a conducive atmosphere.

“The 2024 bidding round is meant for investors with financial capacity and technical competence.

“In the past, the award of oil blocks culminated to the non-development of over 90 per cent of marginal fields, thus denying the federal government of reaping the intended benefits.

“This is because such awards were not based on technical and financial considerations,” he said.

The NUPRC boss said that the recent Presidential Executive Orders issued were aimed at improving the efficiency and attractiveness of Nigeria’s oil and gas sector.

He said that it would culminate in further increasing the nation’s oil and gas reserves.

He added that as at April, it was estimated that Nigeria’s oil reserve was at 37.5 billion barrels of crude oil and condensate reserves, and 209.26 trillion cubic feet of natural gas reserves.

He said that the commission had engaged in several roadshows, held in Houston U.S., Miami, London and Paris, among others.

“We are not just a regulator, but a business enabler. We urge stakeholders to participate in the exercise.

“It will enable us unprecedented opportunity to unlock Nigeria’s vast hydrocarbon potential, attract investment and propel our nation towards greater economic prosperity and shared prosperity,” he stated.

He said each block had been chosen for its potential to bolster the nation’s reserve and economic posterity.

Komolafe said that the total number of blocks were 12 as at planning stage.

“But they were later able to gather data to offer more oil blocks. So, it is increasing the number of blocks and the details willl be made available on the portal,” Komolafe said.

The NUPRC boss also said that the commission had issued a licensing round guideline and published the grand plan.

Komolafe said that the blocks on offer have extensive 2D and 3D seismic coverage including logic and analog data.

According to him, the objectives of the exercise are; to grow oil, gas reserves, to boost production, to enhance Nigerian content development and attract investment among others.

He told prospective investors that notwithstanding, the progression of energy transition, fossil fuel would continue to play a key role in the energy provider globally.

The NUPRC boss said that there were plans to also conclude the 2022 block auctions alongside the 2024 oil bid round, while it had offered seven oil blocks in 2022.

He claimed that investors spend less in exploration and production to produce oil in Nigeria because of the depth of the wells.

According to him, the bid round is scheduled to last for nine months, with details on the portal.

He expressed optimism that investors would choose Nigeria, noting that the nation has a stable democracy with a location close to the coastline of 900 meters.

“Nigeria’s has ease of access to the Europe, American market, attractive fiscal regime; effective regulatory regime; presence of IOCs with confidence in Nigeria; ease of discovery and high productivity, among others.

Also, the Executive Director of Schlumberger, Dr Nosa Omorodion, said, “This is an opportunity for NUPRC to demonstrate that Nigeria is ready for business.”

He also said that integrity remained important while ensuring that things were done according to the rules.

He stressed that corporate governance and competency were key.

He said that the new bloc that would be placed should be published and made open for perspectives investors to see.

Mr Hans Nijkamp, Gas and Commercial Director, Shell E&P Africa, said: “Shell has been in Nigeria since 1937 and we are ready to stay for a very long time.

Noting that the deepwater is the company’s ‘playground’ for the future, Hans said Nigeria is currently on track.

He added, “The fiscal regulatory framework makes it look like Nigeria is already in the future.”

He explained that the company is determined to focus on oil and gas in the deepwater and taking the gas to the domestic market through the NLNG.

According to him, the PIA is a groundbreaking moment, as it has improved things, significantly, in the sector.

He, however, urged the government to address in the area of non-associated gas.

“The PIA and the Executive Order signed by Mr President together makes Nigeria more competitive,” he said.

About 300 participants attended the pre-oil bid round conference.