CHIGOZIE AMADI

The vast ocean of global investment holds immense opportunity, but hidden risks lurk beneath the surface. Unpredictable challenges can quickly turn ambition into uncertainty. This is where a skilled private banker becomes your indispensable guide.

As a High-Net-Worth Individual (HNWI) or Ultra-High-Net-Worth Individual (UHNI), you deserve more than generic solutions. You deserve a trusted advisor who can navigate the complexities of global investing with clarity and purpose. Here’s how private banking empowers you to do just that.

1. Beyond traditional banking

Building a lasting legacy demands a sophisticated approach. HNWIs and UHNIs have unique financial needs beyond the scope of traditional banking. Private bankers, with their expertise in tailored wealth management strategies, can help unlock your full financial potential and ensure your legacy endures.

2. Wealth Management solutions for multi-generational demands

The traditional approach to wealth management is being challenged by a new generation of affluent investors. These HNWIs and UHNIs are tech-savvy individuals who demand seamless digital tools to manage their wealth. They also have investment philosophies different from the generation before them – a higher risk tolerance and actively seeking out audacious investment opportunities. Coronation Merchant Bank understands these unique goals and is poised to bridge the gap between their ambition and financial expertise.

3. Private Banking goes local

Previously, international institutions dominated the Nigerian private banking landscape. Many Nigerian HNWIs and UHNIs relied solely on global banks for their wealth management needs.

However, the landscape is changing. Renowned Nigerian institutions have stepped up to offer solutions tailored specifically for you.

Private banking seamlessly integrates banking, investments, and lifestyle services into a single, user-friendly digital platform. This strategic combination allows clients to efficiently manage their finances, anytime, anywhere.

Taking this a step further, Coronation goes beyond financial services and offers a holistic lifestyle experience. This includes exclusive events like our Art Gallery Event, a unique space to connect with fellow art enthusiasts while experiencing Coronation’s commitment to your passions.

Now, let us delve deeper. What sets private banking apart from traditional wealth management?

1. What uniquely sets Private Banking apart?

It’s the combination of a holistic approach and advanced technology. These institutions take a comprehensive approach, building a deep understanding of each client’s unique needs and financial strength. Through advanced technology, they analyze client data, focusing on preferences.

For example, Artificial Intelligence (AI) algorithms can constantly monitor market trends and make data-driven adjustments to your investment portfolio. Your private banker could leverage this information to proactively discuss strategies to mitigate risks and capitalize on promising opportunities.

2. The power of secure investments

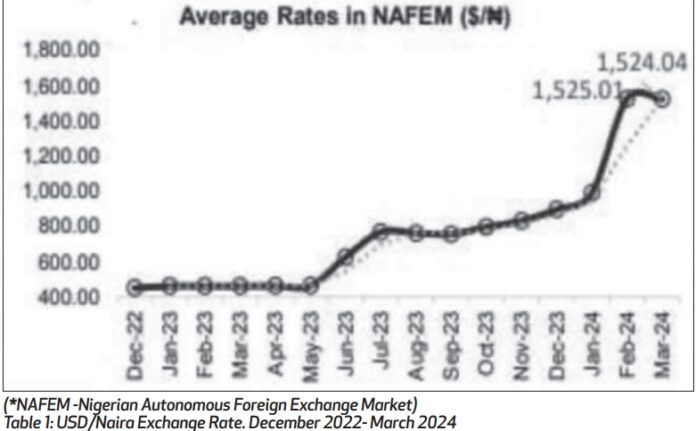

The reward for such proactive risk mitigation is not only financial returns. For instance, the complexities of navigating a volatile market like the Foreign Exchange (FX) Market. Recent fluctuations in the naira’s value have indeed increased focus on this area. By mitigating these risks and capitalizing on potential opportunities, you can invest with confidence.

A private banker is your best ally in this instance. They have access to a wealth of data and resources, providing you with insights to make informed investment decisions. Even in fluctuating markets (as shown in the table below), they can help you determine the optimal time to buy and sell, maximizing potential returns or minimizing losses.

What is the Coronation Advantage?

Coronation Merchant Bank offers private banking solutions for HNWIs or UHNIs, whether you’re based in Nigeria or abroad. We leverage global and local expertise to deliver solutions for growing, preserving, and transferring wealth. This includes investment options, asset management, estate planning, and even specialized financing.

By focusing on the future and building strong relationships, private bankers ensure their clients’ unique needs are met.