The stock market of the Nigeria Exchange Limited (NGX) gained N368billion Week-on-Week (WoW) in market capitalisation driven by increased investors’ demand for FBN Holdings Plc, BUA Cement Plc, and Seplat Petroleum Plc.

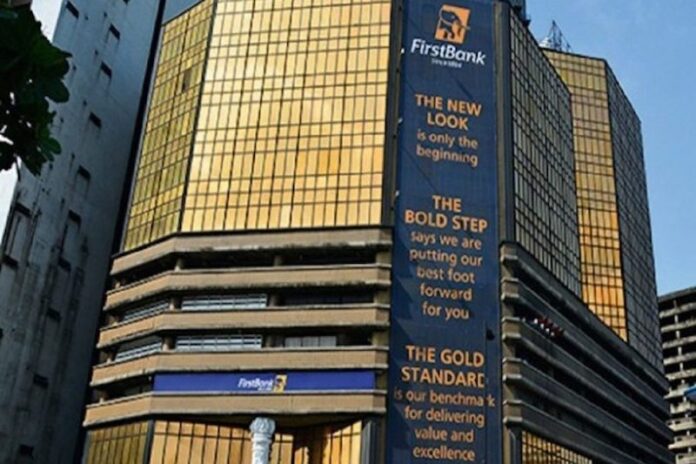

As FBN Holdings appreciated by 12.4 per cent WoW to N20.00 per share, BUA Cement added 6.5 per cent WoW to N107.00 per share and Seplat Petroleum gained 3.9 per cent WoW to N1,980.10 per share, the NGX All-Share Index advanced by 0.93 per cent WoW to close at 70,849.38 basis points.

Also, market capitalisation gained N368 billion WoW to close at N38.925 trillion from N38.557trillion It opened for trading.

Across the sectors, the performance reflects the optimism and confidence of investors amid the ongoing economic developments and anticipation of key reports.

Thus, last week was predominantly bullish, with the exception of the NGX Insurance index, which declined by 0.53 per cent week-on-week.

On the contrary, NGX Oil & Gas index led the gainers, experiencing a 2.91 per cent week-on-week increase. NGX Industrial Goods index followed with a weekly gain of 2.73 per cent, while the NGX Banking and NGX Consumer Goods indices recorded positive movements, rising by 1.17 per cent and 0.05 per cent, respectively.

However, the market breadth for the week was negative as 37 stocks appreciated in price, 43 stocks depreciated in price, while 75 stocks remained unchanged. Japaul Gold & Ventures led the gainers table by 55.91 per cent to close at N1.98, per share.

RT Briscoe followed with a gain of 39.53 per cent to close at 60 kobo, while Glaxo SmithKline Consumer Nigeria went up by 29.44 per cent to close to N16.05, per share.

On the other side, Caverton Offshore Support Group led the decliners table by 13.64 per cent to close at N1.33, per share. The Initiates Plc (TIP) followed with a loss of 10.53 per cent to close at N1.02, while Northern Nigeria Flour Mills (NNFM) declined by 10.00 per cent to close at N18.00, per share.

Overall, a total turnover of 2.525 billion shares worth N45.297 billion in 32,815 deals was traded last week by investors on the floor of the Exchange, in contrast to a total of 2.451 billion shares valued at N40.570 billion that exchanged hands previous week in 37,959 deals.

The Financial Services Industry (measured by volume) led the activity chart with 1.677 billion shares valued at N28.776 billion traded in 14,655 deals; contributing 66.44 per cent and 63.53 per cent to the total equity turnover volume and value respectively. The Oil and Gas Industry followed with 407.350 million shares worth N1.651 billion in 3,273 deals, while the ICT Industry traded a turnover of 120.200 million shares worth N7.255 billion in 2,912 deals.

Trading in the top three equities; Japual Gold and Venture, FBN Holdings (FBNH) and United Bank for Africa (UBA) accounted for 1.030 billion shares worth N14.138 billion in 5,263 deals, contributing 40.80 per cent and 31.21 per cent to the total equity turnover volume and value respectively.

Analysts on the Nigerian capital market have expected equities to sustain positive sentiment this week amidst continuous improvement in investors’ sentiment.

The bullish trend on the Nigerian Exchange persisted for yet another week as investors intensified their buying activities across low, mid, and high-priced stocks. This surge in buying interest is attributed to portfolio reshuffling in anticipation of key macroeconomic reports, including October Inflation, Q3 GDP data, the final MPC meeting for the year, and year-end seasonality.

These factors collectively contributed to a positive impact on the benchmark All-Share Index, which closed higher last week with significant traded volume and positive market breadth.

Looking ahead, Cowry Assets Management Limited expected anticipate the prevailing bullish momentum to persist and to be driven by improved corporate earnings and the commencement of dividend season.

“We believe equity investors will continue to position themselves in dividend-paying stocks. Meanwhile, we continue to advise investors on taking positions in stocks with sound fundamentals,” Cowry said.

Cordros Securities Limited said “this week, we expect the bears to book profit across most counters following the recent market rally. Consequently, we expect a ‘choppy theme’ even as institutional investors search for clues on the direction of yields in the fixed income (FI) market.

“Notwithstanding, we advise investors to take positions in only fundamentally justified stocks as the weak macro environment remains a significant headwind for corporate earnings.”

Analysts at Afrinvest Limited added that “in the week, we expect the bullish momentum to be sustained due to bargain opportunities.”