.Launches RT200 FX Programme”

.Extends 5% interest rate on intervention fund by 1 year

COMFORT EKELEME, Business Editor

The Central Bank of Nigeria (CBN) will stop sale of forex to Deposit Money Banks (DMBs) by the end of 2022.

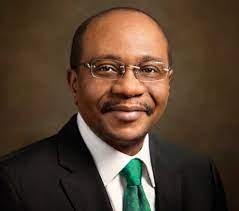

CBN Governor, Mr. Godwin Emefiele who disclosed this in Abuja on Thursday at the end of the Bankers’ Committee Meeting said the time had come for the banks to intensify efforts to source their foreign exchange (FX) by funding entrepreneurs with ideas.

According to him, the CBN will support the banks by granting rebates and through other incentives until the banks find their feet in sourcing their forex by themselves.

He said the apex bank’s policies and measures have led to a significant improvement in Diaspora inflow from an average of $6 million per week in December 2020 to an average of over $100 million per week by January 2022.

“After careful consideration of the available options and wide consultation with the Banking Community, the CBN is, effective immediately, announcing the Bankers’ Committee “RT200 FX Programme”, which stands for the “Race to US$200 billion in FX Repatriation”.

Though he said interest rates on CBN’s various intervention facilities were expected to revert to 9 per cent effective March 1, 2022, the apex bank would retain the rates at 5 per cent for another year.

In view of the promising trajectory it established in economic growth and job creation, the CBN explained that the concessionary interest rate of 5 per cent on its intervention facilities would now be extended until March 1, 2023.

CBN also announced the introduction of the Non-Oil FX Rebate Scheme, a special local currency rebate scheme for non-oil exporters of semi-finished and finished produce who show verifiable evidence of exports proceeds repatriation sold directly into the I & E window to boost liquidity in the market.

According to CBN, although this rebate programme is with immediate effect, the detailed guideline of the scheme would be communicated next week.

Emefiele who, disclosed this Thursday at a virtual press briefing following the Bankers’ Committee Meeting said, its plan is to graduate the percentage of the rebate depending on the level of value addition into the product being exported.

He said the apex bank shall establish the modalities for granting a rebate for each dollar that non-oil exports proceed that an exporter sells into the market, for the benefit of other FX users and not for funding its own operations.

Although this rebate programme is with immediate effect, Emefiele maintained that the detailed guideline of this scheme would be communicated next week.

He also announced the Bankers’ Committee “RT200 FX Programme”, which stands for the “Race to $200 billion in FX Repatriation.

He said that the RT200 FX Programme is a ‘set of policies, plans, and programmes for non-oil exports that will enable us to attain our lofty yet attainable goal of $200 billion in FX repatriation, exclusively from non-oil exports, over the next 3-5 years.

“After careful consideration of the available options and wide consultation with the Banking Community, the CBN is, effective immediately, announcing the Bankers’ Committee “RT200 FX Programme”, which stands for the “Race to $200 billion in FX Repatriation.

“The RT200 Programme will have the following five key anchors: Value-Adding Exports Facility, Non-Oil Commodities Expansion Facility, Non-Oil FX Rebate Scheme, Dedicated Non-Oil Export Terminal, and Biannual Non-Oil Export Summit.

“Let me briefly describe each of these anchors. The Value-Adding Export Facility will provide concessionary and long-term funding for business people who are interested in expanding existing plants or building brand new ones for the sole purpose of adding significant value to our non-oil commodities before exporting the same.

“This is important because the export of primary unprocessed commodities does not yield much in foreign exchange. In Nigeria today, we produce about 770,000 metric tonnes of Sesame, Cashew, and Cocoa. Of this number, about 12,000 metric tonnes are consumed locally and 758,000 metric tonnes are exported.

“The unfortunate thing though is that out of the 758,000 metric tonnes that are exported annually, only 16.8 per cent is processed. The rest are exported as raw sesame, raw cashew, and raw cocoa, thereby giving Nigerian farmers an infinitesimal part of the value chain in these products.

“For example, the global chocolate industry is valued at about $130 billion. Of this amount, Cote D’Ivoire, Ghana, and Nigeria account for more than 72 per cent of global cocoa exports.

“Yet, because we mainly export raw cocoa beans, Cote D’Ivoire gets $3.6 billion annually, Ghana generates $1.9 billion annually and Nigeria gets about $804 million per year from an industry that is worth over $130 billion.

“In contrast to West African countries, Belgium accounted for 11 per cent of global chocolate exports in 2019, at a value of $3.16 billion. Similarly, Germany’s chocolate exports were worth $5.14 billion in the same year. These numbers are the same for other commodities as well,” he said.

Emefiele who, also provided factual updates about the positive outcomes of the various intervention programmes introduced by the apex bank at the onset of COVID-19, maintained that CBN would be reviewing these intervention programmes going forward to ensure that they continue to achieve the desired results.