Data released by the Central Bank of Nigeria (CBN), has revealed that Nigeria recorded $1.855 billion direct remittances in the first nine months of 2023, an increase of 3.74 per cent compared to the $1.817 recorded in the first 9 months in 2022.

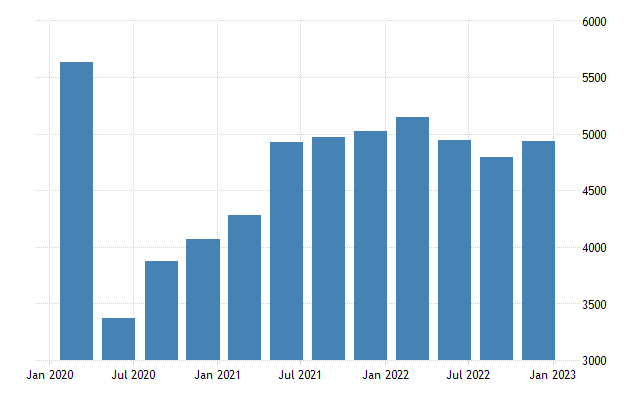

The central bank in its “international payment” data disclosed that in January 2023, direct remittances accounted for $79.2 million, highlighting a steady financial inflow.

According to the CBN, February recorded $83.76 million in remittances, signalling financial stability.

March saw a substantial sum of $138.6 million, showcasing consistent financial support. April followed closely with a remittance of $159.04 million.

As the year progressed, May witnessed an influx of $202 million, reinforcing the nation’s financial stability.

June experienced a significant increase, with $297.4 million in direct remittances, signifying steady financial support. July recorded an influx of $241 million, maintaining a consistent financial inflow.

The detailed breakdown of remittances indicates that August recorded the highest inflow of remittances in 2023 with $591 million while September saw the opposite contract recording the lowest in 2023 at $71 million.

Analysts believe direct remittances will continue to improve due to an increase in immigration, removal of restrictions on domiciliary accounts and rebound in the global economy.

Speaking, Head, of Financial Institutions Ratings at Agusto & Co, Mr. Ayokunle Olubunmi said there are more incentives to bring in remittances through the official channels adding that he foresees an increase in the upcoming data for the coming months.

Olubunmi said: “Before there were a lot of restrictions on the exchange rate used but now, you notice that with the gradual lifting of the various restrictions on the operation of domiciliary accounts, the channels in which you’re sending it played a role in this increase.

Remittances have increased and remittances coming through the official channel have actually also increased. Secondly, we are also reaping the impact of the growing emigrant community we have. Because now with this Japan syndrome, a lot of people that actually are they are they’re settling down, you notice that some of them will also be sending some funds to their dependents, friends, and family.

“Thirdly, you notice that in the global economy various, economies are gradually recovering more from the pandemic. So as they are gradually recovering, Nigerians out there are making more money, and then also the ability to send more funds to siblings and friends in Nigeria has also improved.”

He added: “In the near term, it is going continue especially as some of those who ‘Japa’ with loans would also be settling their back in Nigeria once they settle down.”