Amadi Chigozie writes on the continuous stream of accolades bestowed upon FirstBank Nigeria, commending the exceptional manner in which the institution manages its corporate clients, facilitating smoother business operations for its customers

In the dynamic realm of corporate finance, success is an intricate tapestry woven with threads of trust, innovation, and an unwavering commitment to customer satisfaction. Against this backdrop, FirstBank, Nigeria has not only weathered the test of time but has emerged triumphant, securing the esteemed title of Best Corporate Bank at the recent Euromoney Awards for Excellence, Nigeria 2023. This achievement echoes loudly, reflecting FirstBank’s remarkable journey spanning 130 years marked by resilience, adaptation, and an enduring dedication to its customers.

A Legacy of Excellence

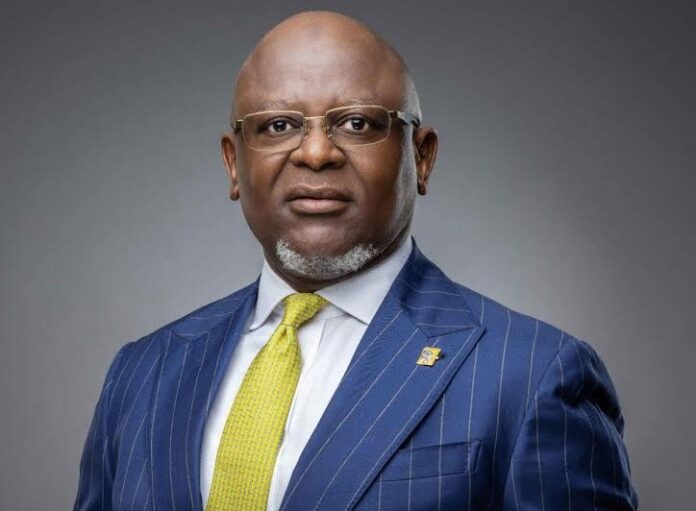

FirstBank’s victory at the Euromoney Awards for Excellence is no stroke of luck but rather the culmination of a relentless pursuit of excellence. At its core lies a deep-seated commitment to enabling corporate success through tailored financial solutions. The Chief Executive Officer of FirstBank, Dr. Adesola Adeduntan, acknowledges, “We are thrilled to announce that we have been recognised as the Best Corporate Bank in Nigeria at the Euromoney Awards for Excellence 2023.” This statement goes beyond a mere announcement it is a testament to FirstBank’s enduring commitment to its customers and their journey towards success.

Technological Innovation: FirstDirect 2.0

Integral to this success is FirstBank’s continuous investment in technology, exemplified by the development of its cutting-edge transaction banking platform, FirstDirect2.0. This smart and interactive platform serves as a one-stop-shop online banking solution for corporates, offering best-in-class capabilities such as Payments, Collections, and Account Services. The Executive Director, Corporate Banking, FirstBank, Mr. Tosin Adewuyi in a recent radio interview said: “We put a lot of resources into our systems and we have a transaction banking system First Direct 2.0. First Direct is pretty transformative and we’ve received lots and lots of accolades in terms of customer experience and customer onboarding. And today, I believe that I checked the numbers last week because I knew I was coming to your show, we have 4200 Already onboarded. 5 million transactions come through that system. So that is to make in our clients business and lives as simple as possible and seamless transaction execution. So really, it’s all about the customer and I can’t stress that enough, we are focused on the customer and it is clearly showing in the feedback that we getting.”

Corporate Banking Redefined

FirstBank’s Corporate Banking model is not just about delivering services; it’s about ensuring consistent quality across the bank’s geographical locations. The Global Account Management (GAM) Framework plays a pivotal role in enhancing cross-relationship management, providing tailored solutions to customers with a Pan African footprint. This strategic approach not only fosters trust but positions FirstBank as a reliable partner in the corporate ecosystem.

Adewuyi said: “In essence, we make sure that we’re focused on making the client’s activities a lot easier. So, if I use an example, how we leverage technology, you know, how we transform digitally, corporates clearly are focused on their payments, they are focused on their collections, their liquidity, how they manage the accounts, supply chain financing for the vendors, and also the buyers, the trade finance, how the imports how they run through the cash cycles

Customer-Centric Ethos

Beyond technological prowess, FirstBank’s success story is rooted in a customer-centric ethos that permeates every aspect of its operations. The dedication to diversity and inclusion is exemplified by the bank’s initiatives, such as the FirstBank Women Network and its membership in UN Women, aligning with broader goals of inclusive growth and empowerment.

Adewuyi added: “Best corporate bank in Nigeria for 2023 essentially is a validation of what we’ve been working on for a number of years.” This validation, received from a prestigious award like Euromoney, serves as a testament to FirstBank’s unique methodology, positioning the institution as more than just bankers but as systemic advisers to the businesses they cover.

“Our methodology is quite unique in the marketplace. And, you know, we, everyone calls us bankers, yes, we are bankers, but we are rarely transactional. So it’s really about being a systemic adviser to the businesses that we cover. We call it a way of doing business for us which means we’re always putting the client first. And we’ve taken that to its extent, in terms of how we cover the clients, how we meet their needs, how we understand the business that they do, and making sure that every point we are relevant, and we are seen more than a bank but we are seen actually as an advisor. That brings us into the whole ecosystem, allows us to do well, and also allows the clients to feel good about how we cover them what we do, and how we do it.”

Evolution and Adaptability

FirstBank’s journey since its establishment in 1894 is not just a tale of accolades; it’s a narrative of resilience, evolution, and staying ahead of the curve. As Mr. Adewuyi points out, “We have been around since 1894. That longevity speaks to how we evolve, reinvent ourselves, how we innovate.”

This adaptability, he said, coupled with a relentless focus on customer needs, has been the cornerstone of FirstBank’s success.

“So, it’s really about making sure that we continue to reinvent ourselves. And essentially, that’s the way we stayed in business. So next month, I believe, will be 130 years of First Bank in existence. And that is a major, major feat. We continue to make sure that we don’t get complacent, we stay relevant as their business is evolving, our business is evolving alongside and together we cover the entire ecosystem,” he added.

Guiding Principles for the Future

FirstBank’s success story is not just about accolades; it’s about resilience, evolution, and staying ahead of the curve. As Mr. Tosin Adewuyi, Executive Director of Corporate Banking at FirstBank, highlighted, the bank’s longevity since 1894 speaks volumes about its ability to reinvent itself and stay relevant in a rapidly changing landscape. This adaptability, coupled with a relentless focus on customer needs, has been the cornerstone of FirstBank’s success, enabling it to navigate challenges and emerge stronger.

In essence, FirstBank’s triumph at the 2023 Euromoney Awards for Excellence is a testament to its unwavering commitment to customer satisfaction, innovation, and excellence. As the bank continues to chart new territories and redefine corporate banking, one thing remains certain: its customers will always come first. In a world driven by change, FirstBank stands as a beacon of stability, reliability, and trust, guiding corporate clients towards success in every step of their journey.